Receita Federal

- Tools

- 4.3.0

- 65.6 MB

- by Serviços e Informações do Brasil

- Android 8.0+

- Apr 24,2025

- Package Name: br.gov.economia.receita.rfb

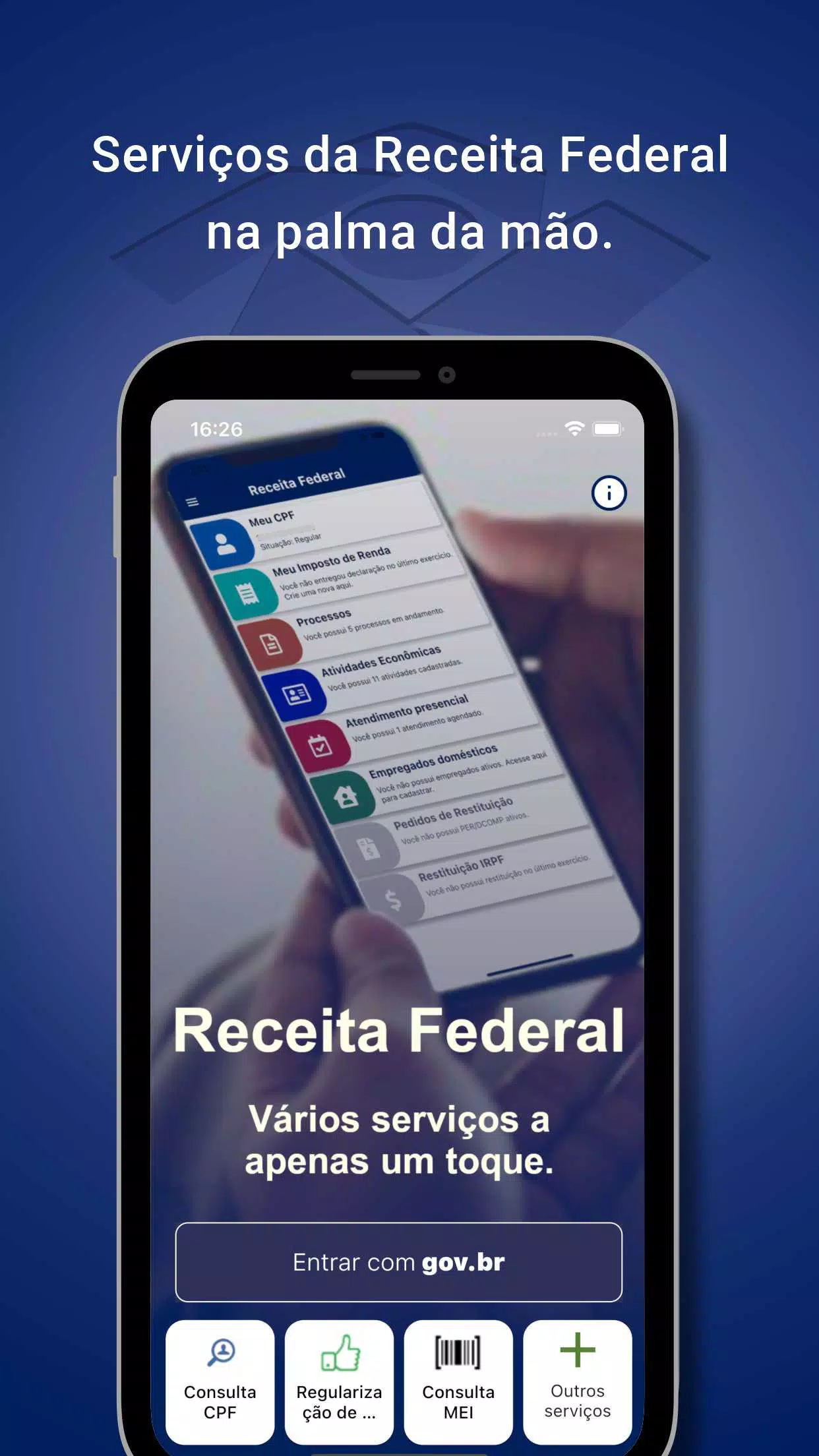

The Internal Revenue Service (IRS) provides a comprehensive suite of services to assist citizens in managing their financial and tax-related affairs efficiently. By leveraging various Federal Revenue systems, the IRS offers an array of tools designed to enhance transparency and facilitate easy access to essential information. Some services, marked with an asterisk (\*), require the download of an additional Federal Revenue application to access.

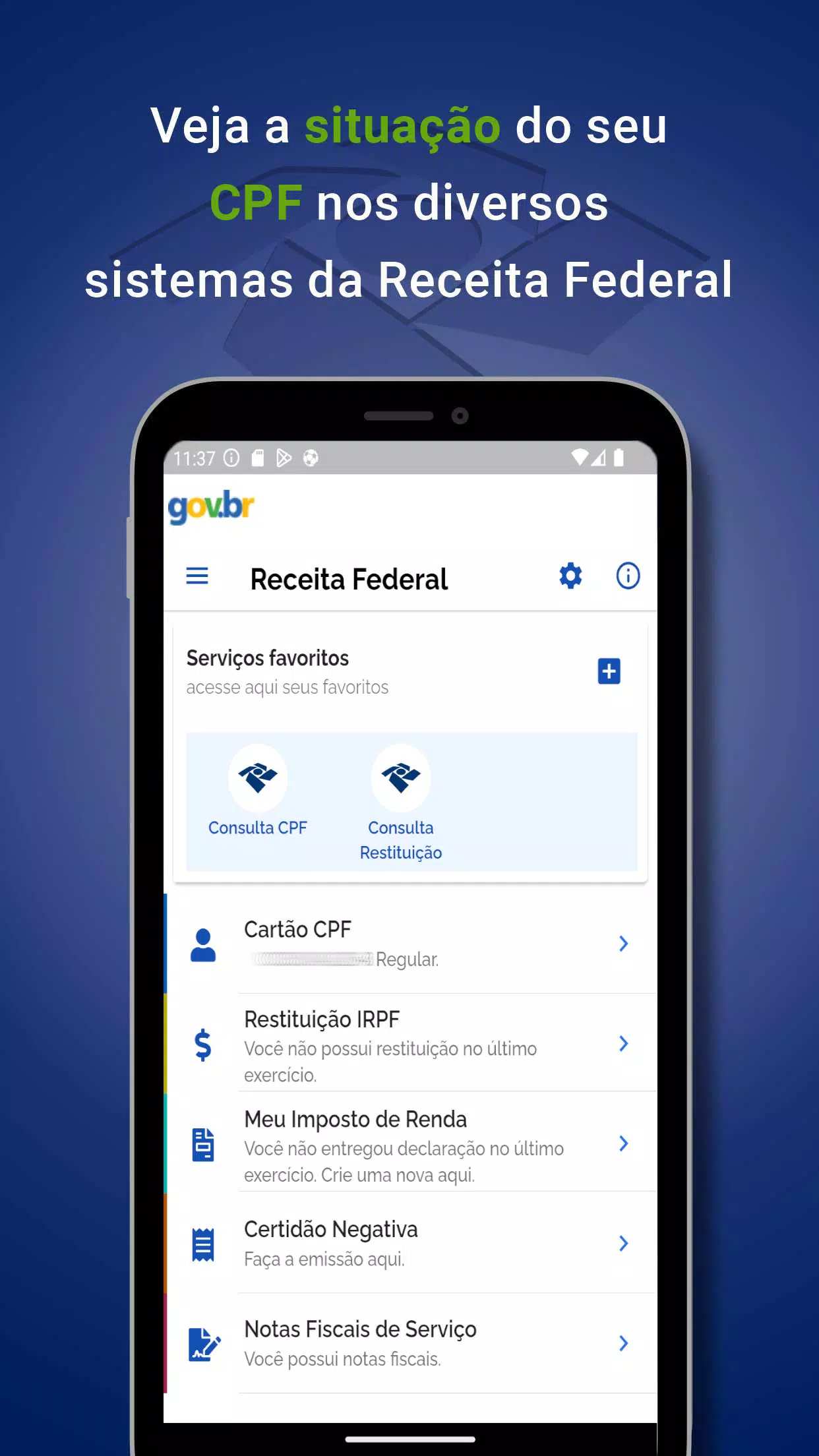

The IRS application provides detailed insights into the following areas:

- CPF Card: View your Citizen's Personal Record (CPF) card details.

- Negative Certificate of Debts: Access documentation that verifies no outstanding debts are registered against your CPF.

- IRPF Refund: Track the status of your Income Tax Refund.

- Income Tax Declarations*: Review and manage your income tax filings.

- Processes in Progress*: Monitor any ongoing processes related to your tax affairs.

- Economic Activities – CAEPF: Check the registration of your economic activities.

- Schedules - SAGA*: Access scheduling services for various federal revenue-related appointments.

- eSocial – Domestic Employees*: Manage your responsibilities as an employer of domestic workers.

- My Companies (including MEI*): View information about companies you are associated with, including micro-entrepreneurship initiatives.

- My Imports (Import Declarations and Bill of Lading): Access details related to your import activities.

- Refund Requests via PERDCOMP: Submit and track requests for tax refunds through the PERDCOMP system.

- Service Invoices: View and manage invoices for services provided or received.

- Health Recipe: Access information relevant to your health-related expenditures.

Additionally, you can consult a wide range of other services including CNPJ registration, MEI status, CNAE, NCM tables, RFB Units, legal regulations, Sicalc, import simulation, and more, all designed to streamline your interaction with federal revenue systems.

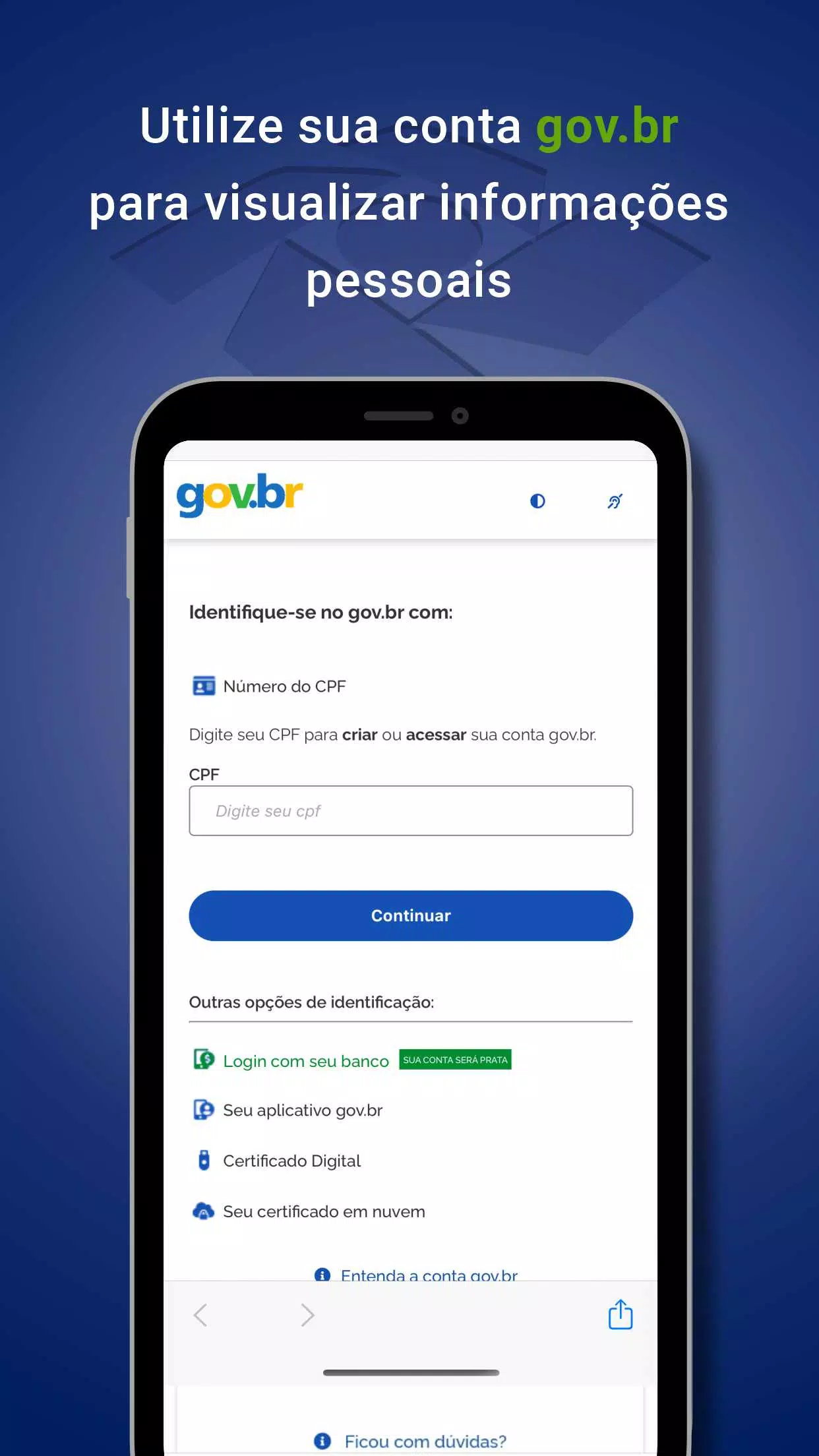

The way information is presented varies based on user authentication status:

- Non-Authenticated Users (without gov.br): You will have access to basic data only. Each query requires completing a captcha, and you will not be able to save favorites for future reference.

- Authenticated Users (with gov.br): Enjoy a seamless experience without captchas. You can save your queries as favorites for quick access in the future. Additionally, you will soon receive alerts about any movements related to your queries.

- Consulting Third-Party Data: Authenticated users can view basic information about third parties.

- Consulting Your Own Data (My Data): Authenticated users have full access to their personal information, enabling a more comprehensive overview and management of their tax and financial affairs.

By providing these services, the IRS aims to enhance the efficiency and accessibility of federal revenue systems for all citizens, ensuring they can easily manage their fiscal responsibilities and stay informed about their financial status.

-

Top Heroes in Fist Out CCG Duel: 2025 Tier List Revealed

Fist Out: CCG Duel – A High-Octane Martial Arts Card BattlerFist Out: CCG Duel is an electrifying collectible card game (CCG) that blends the intensity of martial arts combat with deep strategic gameplay. Set in a richly detailed universe filled with underground fighters, ancient rivalries, and secr

Jun 17,2025 -

Hayden Christensen Confirmed to Reprise Anakin Skywalker Role in Ahsoka Season 2 at Star Wars Celebration

Big news for *Star Wars* fans was revealed at Star Wars Celebration: Hayden Christensen is officially returning as Anakin Skywalker in Season 2 of *Ahsoka*. While specific details about Anakin’s role in the upcoming season remain under wraps, this announcement is sure to excite fans who have been ea

Jun 17,2025 - ◇ "Ultra: New Hardcore Retro Platformer Hits Android" Jun 17,2025

- ◇ "Top Deals: Nintendo Switch 2 Preorders, 4K Blu-rays Available Now" Jun 17,2025

- ◇ "Reverse 1999 and Assassin’s Creed to Collaborate in August 2025 Event" Jun 16,2025

- ◇ "The Seven Deadly Sins: Grand Cross Marks 6th Anniversary with New Heroes and Events" Jun 16,2025

- ◇ Fire Spirit Cookie: PvE Build and Usage Guide in CookieRun Kingdom Jun 16,2025

- ◇ Peacock TV Annual Subscription Now Only $24.99 - Just $2 Monthly Jun 15,2025

- ◇ Best Victoria Hand Decks in Marvel Snap Jun 15,2025

- ◇ Alolan Ninetales Joins Pokemon TCG Pocket's New Drop Event Jun 15,2025

- ◇ Season 20 of Fallout 76 Introduces Ghoul Transformation and New Mechanics Jun 15,2025

- ◇ "Silksong Team's Deadpool VR Callout Surprises Fans" Jun 15,2025

- 1 Roblox Forsaken Characters Tier List 2025 Feb 14,2025

- 2 Pokemon Go’s first Community Day of 2025 will feature Sprigaito Jan 05,2025

- 3 Holiday Thief Arrives in Seekers Notes Dec 26,2024

- 4 Watcher of Realms Is Dropping New Heroes and Skins This Thanksgiving and Black Friday! Dec 30,2024

- 5 Jujutsu Kaisen Phantom Parade: Tier List Update for 2024 Dec 28,2024

- 6 How To Find and Beat the Storm King in LEGO Fortnite Jan 05,2025

- 7 Goddess Of Victory: Nikke Is Dropping a New Year’s Update and Collabs with Evangelion and Stellar Blade Soon Jan 04,2025

- 8 Marvel Rivals' Controversial Hitbox System Draws Attention Feb 11,2025

-

Mastering the Art of Digital Tools

A total of 10

-

Hidden Gems: Unexpectedly Useful Other Apps

A total of 10

-

Top Free Adventure Necessary Games for Android

A total of 4